Assignments

acc 102 Assignment Questions and Answers

please make sure you read and understand the question and each answer before you copy

you can download our app for easy access to materials

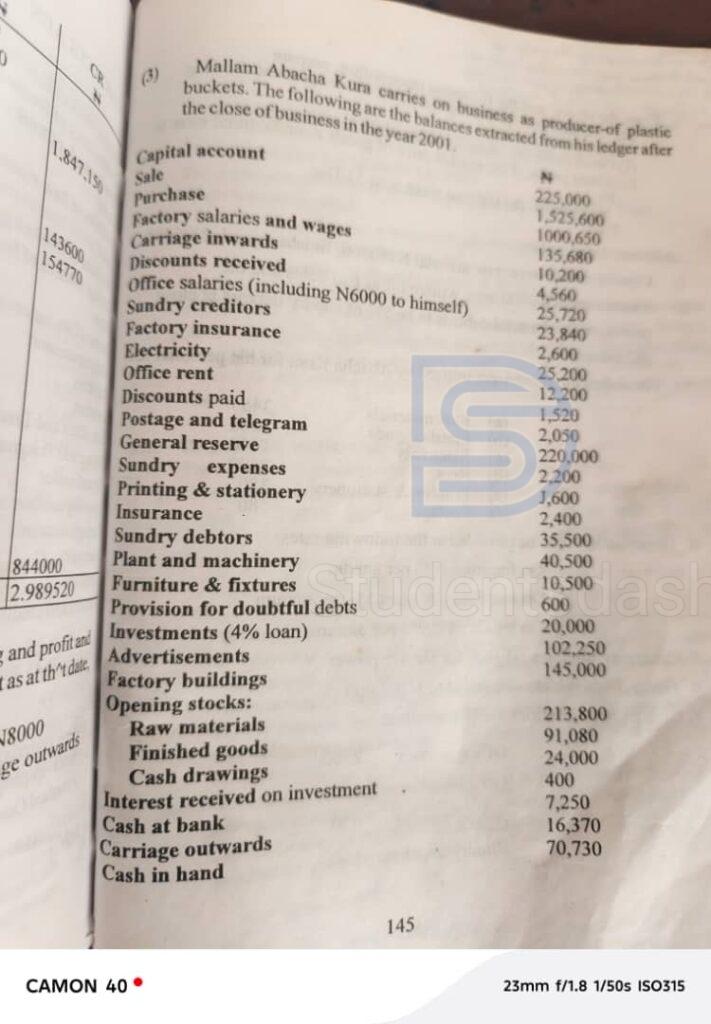

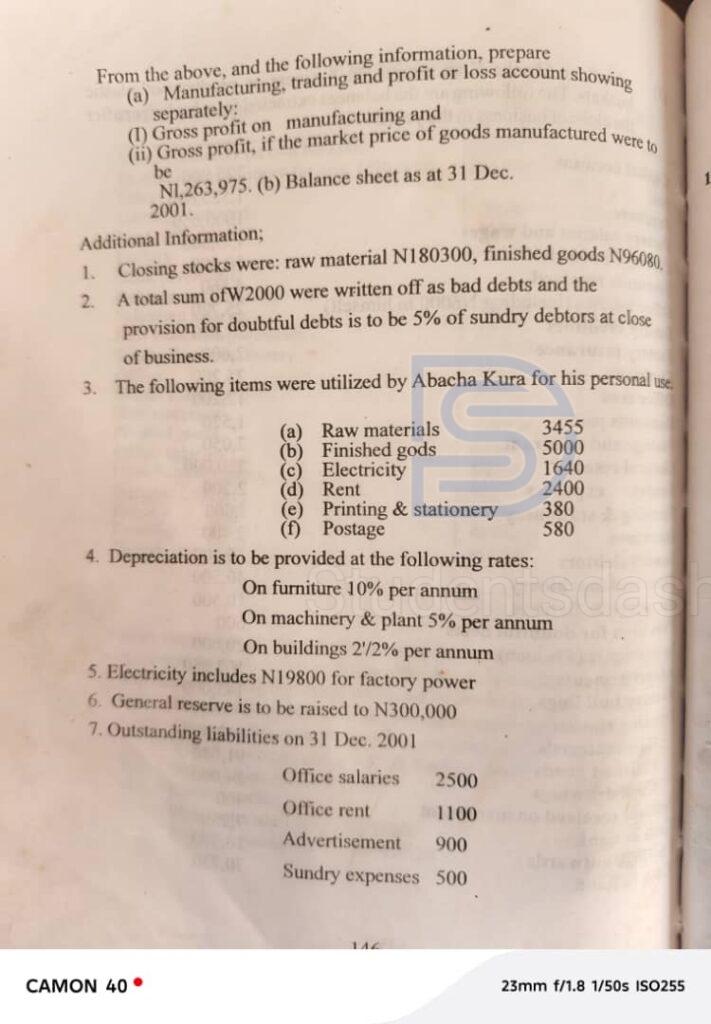

Mallam Abacha Kura

ANSWERS

a) Manufacturing Account

For the year ended 31 December 2001

| Dr. | ₦ | Cr. | ₦ |

| Opening Stock of Raw Materials | 213,800 | ||

| Add: Purchases of Raw Materials | 1,000,650 | ||

| Add: Carriage Inwards | 10,200 | ||

| 1,224,650 | |||

| Less: Closing Stock of Raw Materials | (180,300) | ||

| Less: Raw Materials used personally | (3,455) | ||

| 1,040,895 | |||

| Raw Materials Consumed | 1,040,895 | ||

| Add: Factory Salaries & Wages | 135,680 | ||

| Add: Factory Power (from Electricity) | 19,800 | ||

| Add: Factory Insurance | 2,600 | ||

| Add: Depreciation on Plant & Machinery (5% of 40,500) | 2,025 | ||

| Total Cost of Production | 1,200,000 |

- Raw Materials Consumed:

Opening ₦213,800 + Purchases ₦1,000,650 + Carriage ₦10,200 – Closing ₦180,300 – Personal use ₦3,455 = ₦1,040,895 - Prime Factory Costs (materials + wages + power + insurance + depreciation) = ₦1,200,000

Mallam Abacha Kura

i) Trading Account

For the year ended 31 December 2001

| Dr. | ₦ | Cr. | ₦ |

| Opening Stock of Finished Goods | 91,080 | Sales | 1,525,600 |

| Cost of Production (from Manufacturing A/C) | 1,200,000 | Closing Stock of Finished Goods | 96,080 |

| Finished Goods Drawn for Personal Use | 5,000 | ||

| Gross Profit c/d | 335,600 | ||

| 1,626,680 | 1,626,680 |

Mallam Abacha Kura

ii) Profit & Loss Account

for the year ended 31 December 2001

| Dr. (Expenses & Losses) | ₦ | Cr. (Income & Gains) | ₦ |

| Office Salaries (25,720 + 2,500) | 28,220 | Gross Profit b/d | 335,600 |

| Office Rent (12,200 + 1,100 – 2,400) | 10,900 | Discounts Received | 4,560 |

| Printing & Stationery (3,600 – 380) | 3,220 | Interest on Investments | 7,250 |

| Postage & Telegram (2,050 – 580) | 1,470 | ||

| Advertisements (102,250 + 900) | 103,150 | ||

| Sundry Expenses (2,200 + 500) | 2,700 | ||

| Discount Allowed | 1,520 | ||

| Carriage Outwards | 70,730 | ||

| Insurance | 2,400 | ||

| Depreciation on Furniture (10% of 10,500) | 1,050 | ||

| Depreciation on Buildings (2½% of 145,000) | 3,625 | ||

| Bad Debts Written Off | 2,000 | ||

| Increase in Prov’n for Doubtful Debts (1,675–600) | 1,075 | ||

| Total | 347,410 | ||

| Total | 232,060 | Net Profit c/d | 115,350 |

| (brought down) | 115,350 | ||

| Total | 347,410 | Total | 347,410 |

Appropriation of Net Profit ₦115,350

| Dr. | ₦ | Cr. | ₦ |

| Transfer to General Reserve | 80,000 | Net Profit b/d | 115,350 |

| Net Profit transferred to Capital A/C | 35,350 | ||

| Total | 115,350 | Total | 115,350 |

Mallam Abacha Kura

b) Balance Sheet

As at 31 December 2001

| Liabilities | ₦ | Assets | ₦ |

| Capital (225,000 + 35,350 – 24,000) | 236,350 | Fixed Assets: | |

| General Reserve | 300,000 | Factory Buildings (145,000 – 3,625) | 141,375 |

| Sundry Creditors | 23,840 | Plant & Machinery (40,500 – 2,025) | 38,475 |

| Outstanding Office Salaries | 2,500 | Furniture & Fixtures (10,500 – 1,050) | 9,450 |

| Outstanding Office Rent | 1,100 | Current Assets: | |

| Outstanding Advertisements | 900 | Closing Stock – Finished Goods | 96,080 |

| Outstanding Sundry Expenses | 500 | Closing Stock – Raw Materials | 180,300 |

| Sundry Debtors (35,500 – 600) | 34,900 | ||

| Investments (4% loan) | 20,000 | ||

| Cash at Bank | 7,250 | ||

| Cash in Hand | 70,730 | ||

| Total Liabilities & Equity | 565,190 | Total Assets | 565,190 |

Gross Profit (at market price) = ₦ 271,625